We’re always on a mission to make Catch better. In the past year, we've added Autopilot, Health Insurance, Tax Payments, Family Leave, Faster Transfers, Dark Mode, and more.

Catch has become a lot more robust in the last 12 months, which brings with it added complexity. We've talked to thousands of you and internalized your feedback. We took a hard look at the design of Catch and what opportunities might exist to make the experience smoother.

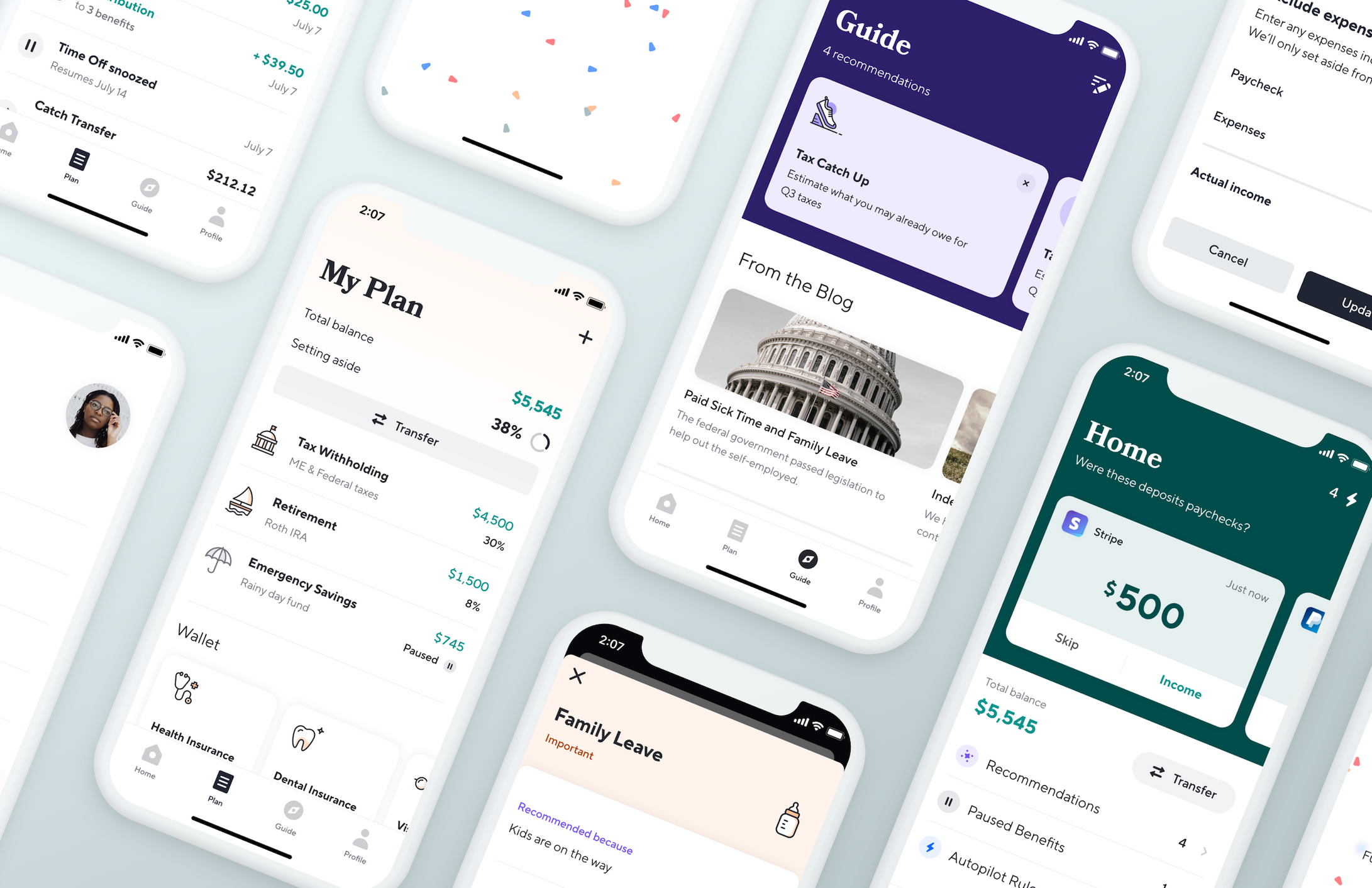

Welcome to Catch 6, codename Smooth

What's new

- Checkup

- We’ve introduced a faster, more conversational onboarding and checkup experience.

- Home

- Your homepage breaks down what needs to be done.

- Plan

- Now it’s your space – focused, simple, accessible.

- Guide

- And a brand new guide– all of our content and recommendations in one place.

And more:

- More flexible paycheck edits

- Custom contribution amounts and the ability to add expenses

- Autopilot improvements

- Optional transfer delays, support for new sources, and more

- Tax Payments are now available for everyone.

- Send a payment to the IRS, directly from Catch.

- You can now snooze withholding.

- Put a benefit on pause, then automatically start saving again in one or two weeks.

- Emergency Savings

- Stash some money away for a rainy day

- Referral bonuses

- Share Catch with friends to get your custom CatchPhrase on a sticker, mug, or t-shirt

- Profile pictures

- Upload a photo for you and any of your family members

Checkup

Checkup has been trimmed down, sped up, and redesigned to feel like even friendlier and more personable. Imagine a quick chat with a friend, except that friend happens to know a thing or two about benefits.

You can now easily retake Checkup through Guide to make sure you're always up to date with the latest recommendations.

Home

Home now includes all the info that matters most, including your total Catch balance and a transfer button for quick deposits or withdrawals. We've also added a snapshot section to highlight any new Guide recommendations, list active Autopilot rules, and remind you of any benefits you've paused.

You'll also notice a new Activity section on Home, giving you a peek at recent transfers and plan updates.

Plan

Plan's been drastically simplified so that you can easily find the info you need and view your entire safety net at a glance. You'll also notice a new transfer button that makes money movement even more intuitive. Plus, an updated Wallet for any insurance policies you may already have covered outside Catch.

Guide

Guide is now home to all of your personal recommendations, helping make sure you're always prepared for whatever life throws at you. Blog posts have been moved to Guide, helping you stay up to date with the latest news and updates. We've also expanded and updated previous Guide content, now known as the Benefits Center: here's your bird's eye view of the full benefits landscape, with recommendation levels based on your unique situation.

A foundation for even more to come

As always, make sure to keep your app updated to get the latest additions. Catch 6 is the foundation for some even more exciting things we've got slated for the year ahead:

- Fully integrated Health Insurance enrollment

- Custom savings goals

- Multiple bank links

- Disability Insurance

- HSA integration

- Family Sharing

- Income Reports